Tesla Homes With Innovative Solar Roofs Tours Available At Power Station Facility

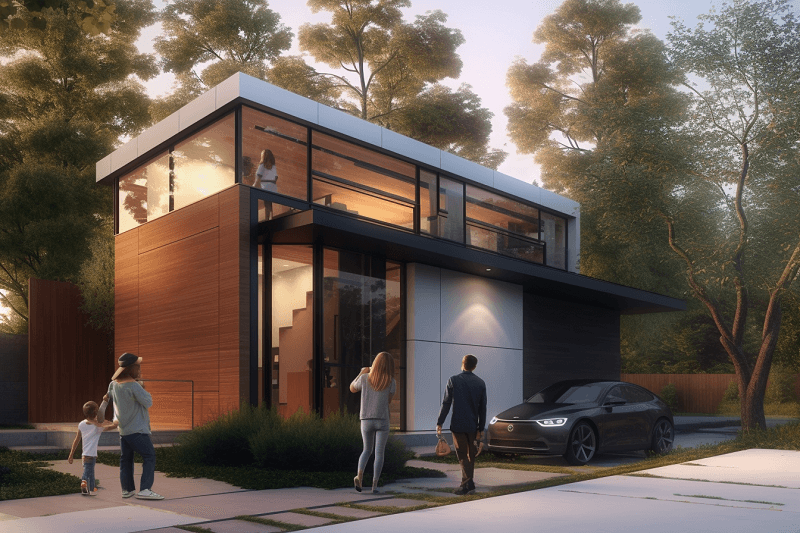

Tesla Homes With Renewable Energy Modern Open Concept House Design

The pattern of tiny homes has gained momentum over latest years as extra people seek alternative residing preparations. These compact spaces not only encourage a minimalist life-style but also appeal to these on the lookout for affordability and sustainability. However, regardless of their smaller size, financing options for tiny homes could be multifaceted and complicated.

Traditional mortgages usually don't apply to tiny homes, especially if they are on wheels or categorized as personal property. Because these structures won't meet commonplace residing requirements, securing a conventional mortgage can be a difficult endeavor. Yet, different financing choices have emerged to meet the needs of aspiring tiny homeowners.

Personal loans are one path people can think about for financing a tiny home. With fewer laws than mortgages, personal loans provide flexibility in phrases of how a lot a borrower can take out, sometimes primarily based on creditworthiness. However, rates of interest can be greater than those of a standard home mortgage, making long-term repayment essential to evaluate.

Some buyers flip to specialised lenders who focus solely on tiny homes. These lenders perceive the distinctive features of tiny home possession and will supply tailor-made monetary merchandise designed specifically for this market. This route can help people navigate the intricacies concerned in acquiring a loan for a non-traditional property.

Tesla Homes Designed For Sustainability House Fire Reported After Heavy Rain

Another in style financing route is thru owner financing. In this state of affairs, the vendor of the tiny home acts because the lender. This option can be advantageous for buyers who may not qualify for conventional financing or who wish to bypass established monetary establishments. The terms are often negotiable, allowing more room for flexibility regarding payment schedules and interest rates.

Building a tiny home can also be funded by way of building loans. These loans are significantly useful for people who want to assemble their very own dwelling from scratch. Builder’s quotes, blueprints, and a proposed timeline are usually needed to secure this funding. However, borrowers must be prepared to provide a major quantity of documentation.

Moreover, 401(k) loans provide another avenue for finance. Individuals can borrow in opposition to their retirement financial savings for the aim of buying a tiny home. While this could be an efficient approach to faucet into present funds with out accruing high-interest debt, it’s essential to weigh the long-term implications on retirement savings and the penalty for non-repayment.

Peer-to-peer lending platforms have risen in popularity, providing an revolutionary financing technique for tiny homes. Through these platforms, individuals can join with investors looking to fund small loans. This permits for probably decrease rates of interest and more lenient phrases than would be obtainable through traditional lenders.

Tesla Homes With Renewable Energy Video Shows Fire During Flooding Conditions

Grants can also play a role in financing tiny homes, particularly for sustainable or environmentally friendly builds. A variety of organizations provide grants for tasks that promote eco-friendly dwelling. Interested individuals should actively seek out native, state, or federal grants that could be out there to them.

Credit unions typically have more flexible loan options in comparison with traditional banks. They may present particular loan programs geared toward first-time home patrons or those purchasing various housing. Being a member of a credit union can yield personalized service and monetary products that cater to the needs of tiny home fanatics.

Tesla Prefab Homes Catching Fire In Flooded Garage

Saving plans and financial strategies are essential for anybody looking to finance a tiny home. Establishing clear budgeting techniques and forming a savings technique can ease financial pressure. Buyers should consider the long-term costs, together with land acquisition, maintenance, and utilities, while setting a practical timeline for their purchasing goals.

Additionally, some patrons are opting to buy land with their tiny homes, making it extra akin to a standard home-buying experience. This method can help solidify property rights and increase the value of the funding. Financing options may differ based on whether or not the land is owned outright or financed individually.

In conclusion, funding a tiny home requires thorough analysis and information of the various financing choices out there. From private loans to specialized lenders, and even potential grants, people can method their aim with a variety of selections that swimsuit their financial profile. Exploring these alternatives permits tiny home lovers to realize their goals imp source while sustaining financial health. Understanding all features of tiny home financing will lead potential householders to make informed decisions tailor-made to their unique conditions.

Tesla Homes For Off-Grid Living Modern Open Concept House Design

- Tiny home loans are specialized financing options that usually have extra lenient requirements and lower down funds compared to traditional mortgages.

(Tesla Homes With Solar And Wind Power)

- Alternative financing sources, such as crowdfunding platforms, enable potential owners to raise funds by seeking contributions from friends, family, and the community.

- Personal loans could be leveraged for tiny home purchases, providing borrowers with versatile mortgage quantities and compensation terms without the need for collateral.

- Some tiny home developers provide in-house financing choices, simplifying the buying course of with custom-made mortgage agreements that fit their particular designs.

Tesla Tiny Homes With Renewable Energy Fire Incident During Flooding Event

- Home equity loans or strains of credit can be utilized by householders to faucet into their present property value, funding the construction or buy of a tiny home.

- Government-backed financing packages may offer help or decrease rates of interest for eco-friendly tiny homes, selling sustainable dwelling practices.

- Conventional mortgage choices are more and more being tailored for tiny homes, particularly these on everlasting foundations, allowing consumers to navigate traditional financing avenues.

- Rent-to-own arrangements present a novel pathway, permitting people to make monthly payments towards eventual possession of a tiny home whereas residing in it.

Tesla Homes With Powerwall Fire Incident During Flooding Event

- Specialized lenders are emerging within the tiny home market, offering tailor-made options that address unique requirements like zoning laws and land purchase assistance.

- Peer-to-peer lending platforms create opportunities for financing by connecting people looking for loans with those prepared to lend, typically at aggressive charges.

What are the most typical financing choices out there for tiny homes?undefinedCommon financing options embrace personal loans, RV loans, traditional mortgages, and specialised tiny home loans. Each has completely different necessities, so it’s important to evaluate which inserts your monetary scenario finest.

Tesla Homes With Solar And Wind Power Catching Fire In Flooded Garage

Can I get a mortgage for a tiny home?undefinedYes, however it is dependent upon whether or not the tiny house is on a everlasting basis and meets native building codes. Many lenders are not conversant in tiny homes, so discovering one that's prepared to finance could be challenging.

What is a tiny home loan?undefinedA tiny home loan is a financing choice specifically designed for tiny houses, usually that includes decrease rates of interest and versatile terms compared to conventional loans. It may require different documentation, so research is essential.

Do I want a down cost for tiny home financing?undefinedYes, most lenders require a down cost, usually starting from 5% to 20% of the loan quantity. A bigger down cost may help secure a greater rate of interest and decrease month-to-month funds.

Tesla Homes For Sustainable Energy New Luxury Entertaining House With Pool

Are there authorities loans available for tiny homes?undefinedWhile there are no specific authorities loans solely for tiny homes, choices like FHA loans or USDA right here rural growth loans may fit if the tiny home meets sure tips. Always verify eligibility primarily based on location and property standing.

What credit score score is needed to finance a tiny home?undefinedGenerally, a credit score of 600 or higher is most popular, though some lenders could enable decrease scores with larger interest rates. A higher credit score rating can result in extra favorable mortgage phrases.

Can I use my present home fairness to finance a tiny home?undefinedYes, in case you have important fairness in your current home, you may think about a house fairness mortgage or line of credit to finance a tiny home - Tesla Homes For Smart Living. This option typically offers decrease interest rates in comparability with unsecured loans.

What are the dangers concerned in financing a tiny home?undefinedRisks include probably excessive rates of interest, issue in promoting the tiny home later, and strict zoning laws that would affect everlasting placement. It’s important to completely research native laws and lender necessities.

Tesla Homes With Solar-Powered Living Spaces House On Fire During Hurricane Event

How will residing in a tiny home affect my insurance coverage rates?undefinedInsurance rates for tiny homes can vary extensively primarily based on location, supplies used, and whether it’s categorized as a cellular or everlasting structure. Shop round with completely different providers to search out one of the best coverage and rates.